Coffee and Cocoa: ONE's Market Insights Reveal Key Drivers of Structural Change

The global markets for coffee and cocoa beans are undergoing significant structural transformations, moving past the traditional one-way flow of "producing countries to consuming countries". Traditionally seen as mere suppliers of raw materials, producing nations are now capturing greater value by increasing both domestic consumption and export of high value-added processed products. This shift is driven by a combination of evolving supply-demand dynamics, climate change, and the diversification of consumer markets, leading the global market to a critical turning point. For logistics providers and supply chain managers, this evolution demands new strategies to navigate growing supply uncertainties and the complex requirements for shipping processed goods.

Evolving trend in coffee and cocoa production ecosystem

A growing trend among agricultural producing nations is the push to process and consume raw materials domestically rather than exporting them in their raw state. This strategy allows them to capture greater value.

In the coffee market, while exports have recently been pressured by adverse weather and tariff impositions, major producing countries are also seeing a rise in domestic value consumption, challenging the traditional paradigm which limits producers to a singular role in the supply chain. This presumption that production and consumption were mutually exclusive roles, is now changing. For instance, Brazil saw its domestic consumption of instant coffee reached an all-time high in 2024. Simultaneously, Brazil is actively enhancing its coffee export value through increased shipments of processed products, with instant coffee exports rising by a record 13% year-on-year in 2024.

The same value-added processing trend is visible in the cocoa market. After 2011, Indonesia dramatically reduced its raw cocoa bean exports following the imposition of export taxes on raw beans and the introduction of tax incentives for domestic processing facilities. Consequently, Indonesia becomes a stronger presence in exporting value-added processed products, such as cocoa butter and cocoa powder. Other major producers like Côte d'Ivoire and Ghana are also adopting the export of processed products, with both governments setting aggressive goals to increase their local processing rates. In fact, cargo movements from Côte d'Ivoire to the United States show that the export volume of processed cocoa paste surpassed that of raw cocoa beans in 2022.

While cocoa butter is often shipped in dry containers, its low melting point of around 37 degree celsius means that depending on the route, measures like insulation, the use of specialized reefer containers, and a reliable end-to-end transportation solution may be necessary to prevent package rupture and secure the product's integrity.

Source: S&P Global Market Intelligence

How domestic demand is creating a new long-haul trade axis?

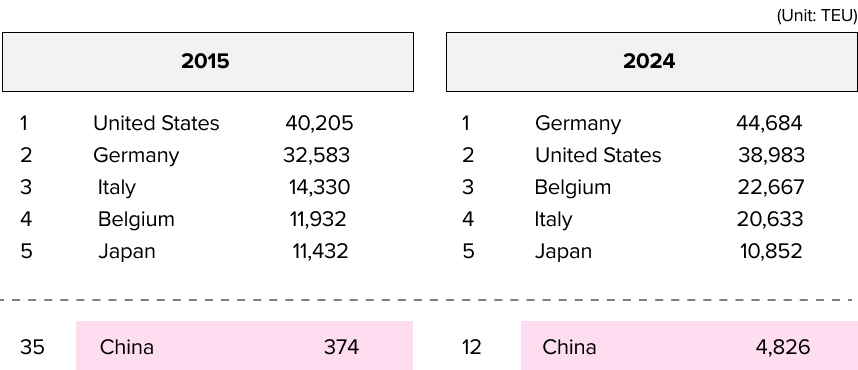

China's coffee market is experiencing a clear surge in domestic demand, quickly establishing the country as a major coffee-consuming nation. China's annual per capita coffee consumption nearly doubled from about 9 cups in 2016 to 16.7 cups in 2023, with projections estimating it will reach 30 cups in 2025. While still low compared to the global average of approximately 150 cups, this rate of growth highlights substantial room for further market expansion.

The rapid growth of local coffee chains symbolizes the firm establishment of a coffee culture and the formation of new consumer segments. In parallel with this demand, supply chain strengthening is progressing. In a key development, one of China's local coffee brands has more than doubled its contract to purchase Brazilian coffee, committing to 240,000 tons by 2029. This significantly enhances the stable supply of Brazilian coffee to China and anticipates further export growth between the two nations. The data shows China's rapid ascent in the global coffee landscape, moving from 35th place for coffee bean export share in 2015 to 12th place in 2024.

This clear surge in domestic demand from China necessitates a robust liner service with frequent trade flows between South America and China. This transformation is part of a larger trend, as the wider Asia-Pacific region is also experiencing an increase in the consumption of both coffee and cocoa, driven by rising disposable incomes, urbanization and a growing consumer culture.

Source: S&P Global Market Intelligence

How are supply uncertainties reshaping cocoa procurement?

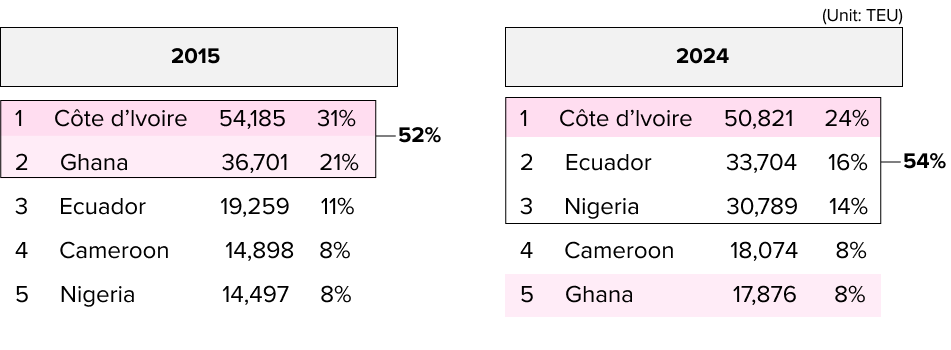

Supply-side risks have become increasingly apparent, driving a shift in international procurement strategies, particularly in the cocoa market. Exports from Côte d'Ivoire and Ghana—the world's two largest cocoa producers—have declined significantly due to a combination of factors, including the effects of climate change, disease outbreaks and aging trees have limited farmer income.

This instability has fundamentally changed the global export balance. In 2015, Côte d'Ivoire and Ghana collectively accounted for 52% of global cocoa bean exports, but their combined share dropped to just 32% by 2024. This vulnerability has prompted international buyers to look toward "semi-producing countries," such as Ecuador, Nigeria, and Cameroon, as alternative, more stable sources. These semi-producing countries are now gaining prominence as crucial hubs in the global supply chain, demonstrating a clear diversification of sourcing for stable supply.

Source: S&P Global Market Intelligence

Your Number ONE Shipping Partner in a Changing Market

The structural shifts in the coffee and cocoa markets—from increased value-added processing to supply chain diversification—introduce new complexities for transportation.

Ocean Network Express (ONE) is your authoritative partner in navigating these dynamic global markets. Leveraging our extensive global network and specialized expertise in container shipping, we are uniquely positioned to support the evolving demands of small and medium-sized enterprises (SMEs) and large-scale importers alike. By anticipating and adapting to the transition from raw materials to locally processed goods, ONE provides the reliable and flexible logistics solutions needed to maintain a robust, future-proof supply chain, ensuring your high-value cargo arrives safely and on time.