Apparel's Great Migration: Navigating Beyond Costs with ONE's Strategic Insights

The map of global apparel production is being redrawn. For decades, East Asia was the undisputed center of manufacturing. Today, a more complex migration is underway, moving not just towards Southeast and South Asia, but into a new era of sourcing strategy. This evolution, which began in the early 2020s and has since accelerated, is driven by a convergence of factors: competitive labor costs, government policies, geopolitical headwinds, and tech-driven disruptions. For shippers and brands, the critical question is no longer just how to ship, but from where to source in a way that builds a resilient, agile, and future-proof supply chain.

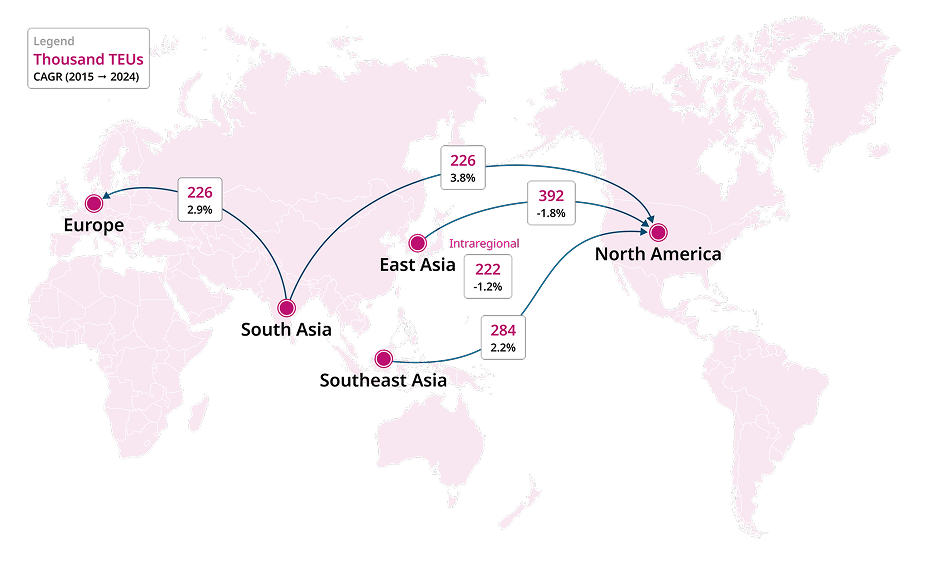

Cargo Volume and CAGR of Apparel by Container Ships for the Top 5 Trade Lanes

Source:S&P Global Market Intelligence

Insight 1:

East Asia's Shifting Role Amid Geopolitical Realities

While East Asia remains a major player, its relative share of apparel exports is contracting. The crucial trade lane from East Asia to North America saw a negative CAGR of -1.2% between 2015 and 2024. This isn't just about rising costs. It's a strategic pivot accelerated by geopolitical tensions and tariff uncertainties. As businesses adopt supply chain diversification strategies to mitigate risks, they are fundamentally altering established trade patterns and enabling the emergence of new, distributed sourcing ecosystems.

Insight 2:

Southeast Asia's Rise as a Sophisticated Hub

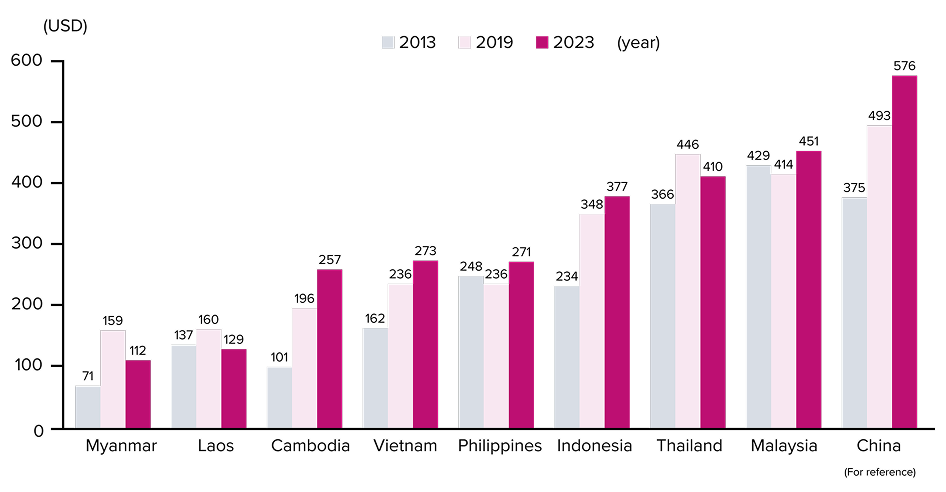

Southeast Asia's emergence is a story of more than just lower wages. The region is evolving into a sophisticated manufacturing hub, attracting significant foreign investment. Vietnam, for instance, is no longer merely a low-cost alternative but a hub for advanced manufacturing capabilities. Proactive government policies, like long-term tax incentives, combined with a growing skilled workforce, are enabling the production of higher-value-added apparel, making the region a compelling, long-term strategic choice.

Average Basic Monthly Wages in the Manufacturing Sector in Major Southeast Asian Countries and China

Source:JETRO.

Insight 3:

South Asia's Power Play with Raw Materials and Scale

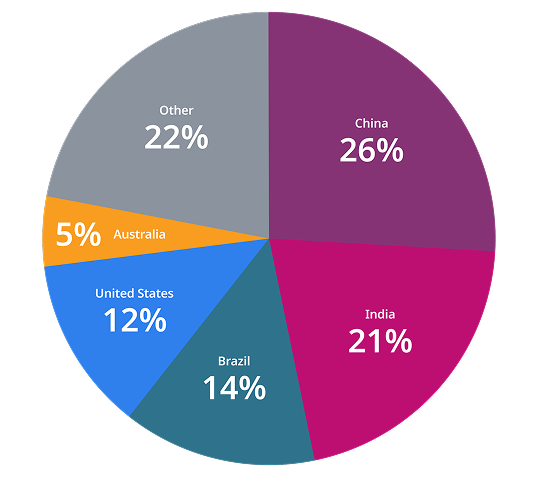

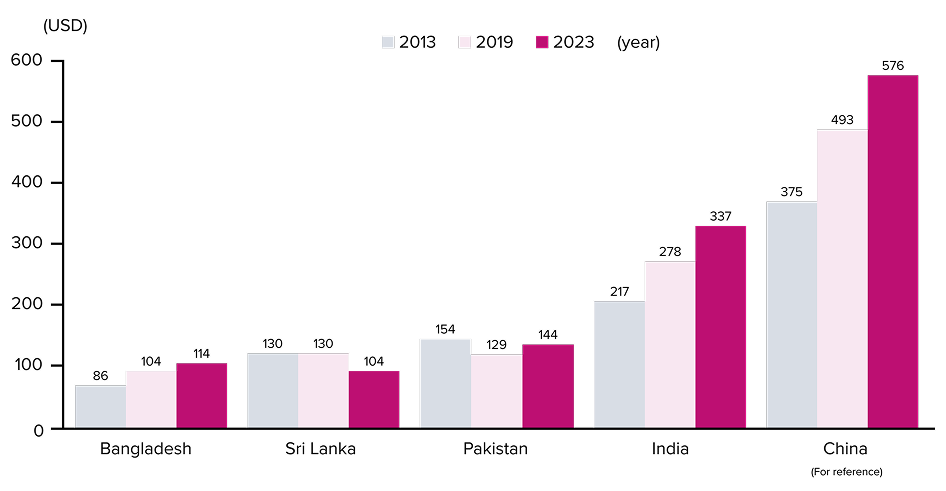

South Asia is leveraging its unique regional advantages to become a sourcing powerhouse. Bangladesh has successfully utilized special economic zones to build a world-class garment industry. Meanwhile, India is capitalizing on its position as the world's second-largest cotton producer, offering manufacturers a stable and cost-effective local supply of essential raw materials. These factors, combined with competitive labor costs, make the region a formidable new force. However, for all its long-term potential, the region faces significant hurdles. Notably, a 50% tariff on Indian apparel exports to the United States makes it a challenging sourcing location for the critical North American market in the near term.

Global Market Share of Cotton Production (2024)

Source: U.S. Department of Agriculture. (2025). Production – Cotton.

Average Basic Monthly Wages in the Manufacturing Sector in China and Major South Asian Countries

Source: JETRO

Insight 4:

Beyond the Basics - The New Factors Shaping Sourcing Decisions

The most forward-thinking companies are looking beyond labor costs and trade policies. Three crucial factors are now defining the next phase of apparel sourcing:

- Vertical Supply Chain Integration: To increase speed and transparency, leading manufacturers are integrating their supply chains—from yarn production to finished garments. This minimizes risk and allows for quicker response to market trends.

- Infrastructure and Connectivity: The quality of ports, roads, and digital infrastructure is paramount. A country's investment in global connectivity is becoming a critical factor in determining its viability as a long-term sourcing partner.

- The E-commerce Disruption: The rise of ultra-fast fashion business models demands unprecedented levels of speed and agility from the supply chain. This is shifting sourcing decisions towards partners who can support rapid production cycles and direct-to-consumer logistics.

Charting Your Course in a New Sourcing Era

Navigating this multifaceted landscape requires more than a simple cost comparison. The interplay of geopolitics, advanced manufacturing, infrastructure quality, and the demands of e-commerce creates a complex challenge. Success depends on a logistics partner with deep, on-the-ground expertise in these emerging regions.

Ocean Network Express (ONE) provides the flexible, reliable, and intelligent container shipping solutions necessary to thrive in this dynamic environment. Our agile network and market intelligence help you capitalize on new sourcing opportunities confidently, ensuring your supply chain is not just a cost center, but a competitive advantage.

Data Sources: Insights and data presented in this article are based on information from leading global organizations, including S&P Global Market Intelligence, Nikkei, the Japan External Trade Organization (JETRO), and other publicly available sources.